CRA Public File

Branch Locations / Available Products

| LOCATION | HOURS | AVAILABLE PRODUCTS |

|---|---|---|

| Full-Service Branch 1501 E Oak St Mahomet, IL 61853 Opened June 2006 |

Monday-Friday 8:00 AM-6:00 PM Saturday 9:00 AM-12:00 PM |

Loan Deposits ATM-available 24/7 Safe Deposit Boxes Night Depository |

| Full-Service Branch 3105 S Staley Rd Champaign, IL 61822 Opened August 2021 |

Monday-Friday 8:00 AM-5:00 PM Saturday 9:00 AM-12:00 PM |

Loan Deposits 2 ATMs-available 24/7; each accepts deposits Night Depository |

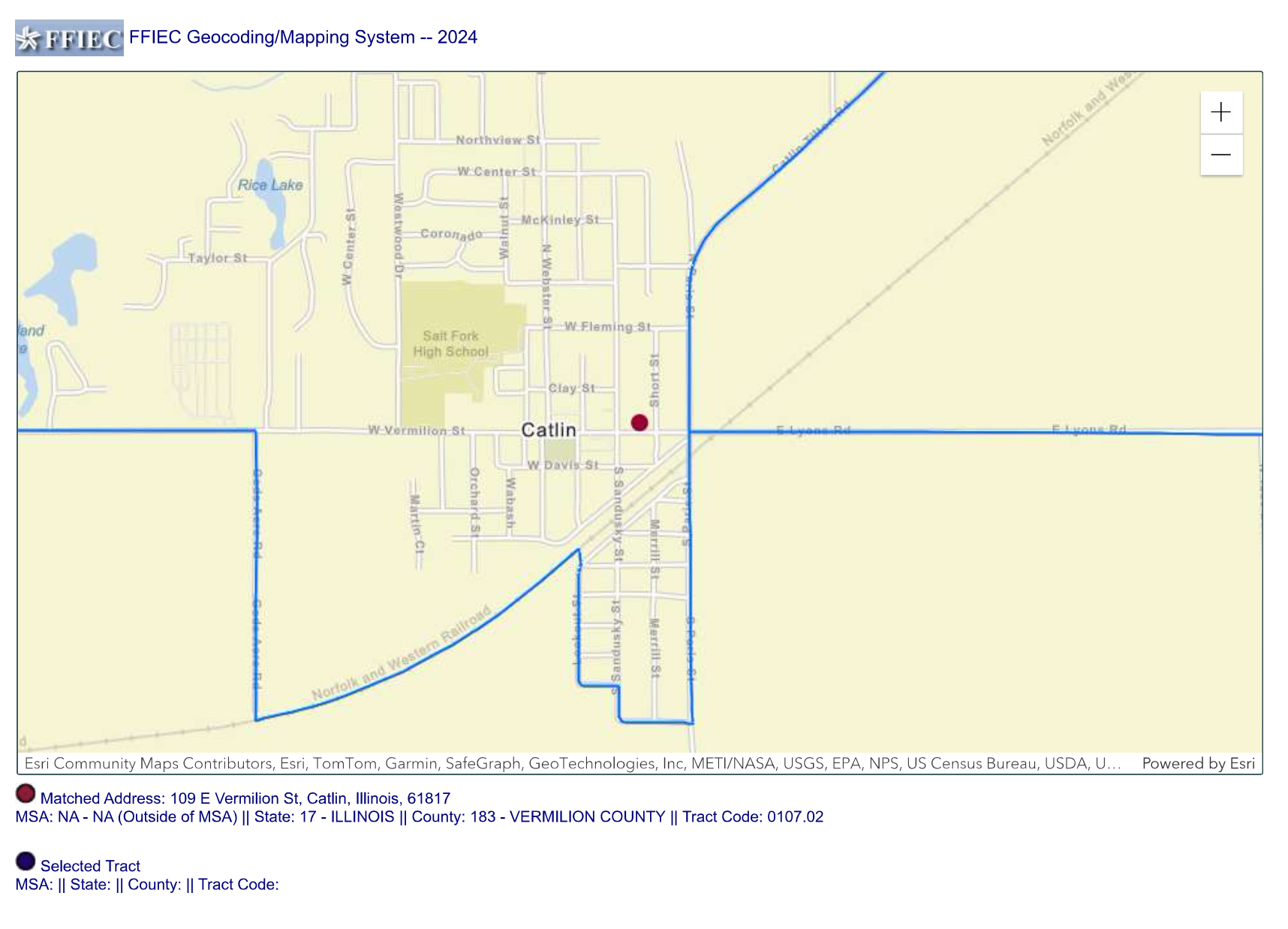

| Full-Service Branch 109 E Vermilion St Catlin, IL 61817 Acquired June 2023 |

Monday-Friday 8:00 AM-5:00 PM Saturday 8:00 AM-12:00 PM (drive) |

Loan Deposits ATM-available 24/7; accepts deposits Safe Deposit Boxes Night Depository |

| Full-Service Branch 1002 N Main St Georgetown, IL 61846 Acquired June 2023 |

Monday-Friday 8:00 AM-5:00 PM Saturday Closed |

Loan Deposits ATM-available 24/7 Night Depository |

| Full-Service Branch 2490 N Vermilion St Danville IL 61832 Opened July 2024 |

Monday-Friday 8:00 AM-5:00 PM Saturday (drive) 8:00 AM-12:00 PM |

Loan Deposits ATM-available 24/7 Safe Deposit Boxes Night Depository |

| Stand-alone ATM 303 N Gilbert St Danville, IL 61832 Acquired June 2023 |

24 Hours a day/7 Days a Week | ATM-available 24/7; accepts deposits |

FFIEC Geocoding

The Fisher National Bank Quarterly Loan to Deposit History

| DATE | TOTAL LOANS | TOTAL DEPOSITS | PERCENTAGE |

|---|---|---|---|

| 06/30/2024 | $249,696,246 | $287,903,938 | 86.73% |

| 03/31/2024 | $243,516,912 | $279,059,274 | 87.26% |

| 12/31/2023 | $244,388,268 | $276,511,039 | 88.38% |

| 09/30/2023 | $237,625,257 | $265,120,396 | 89.63% |

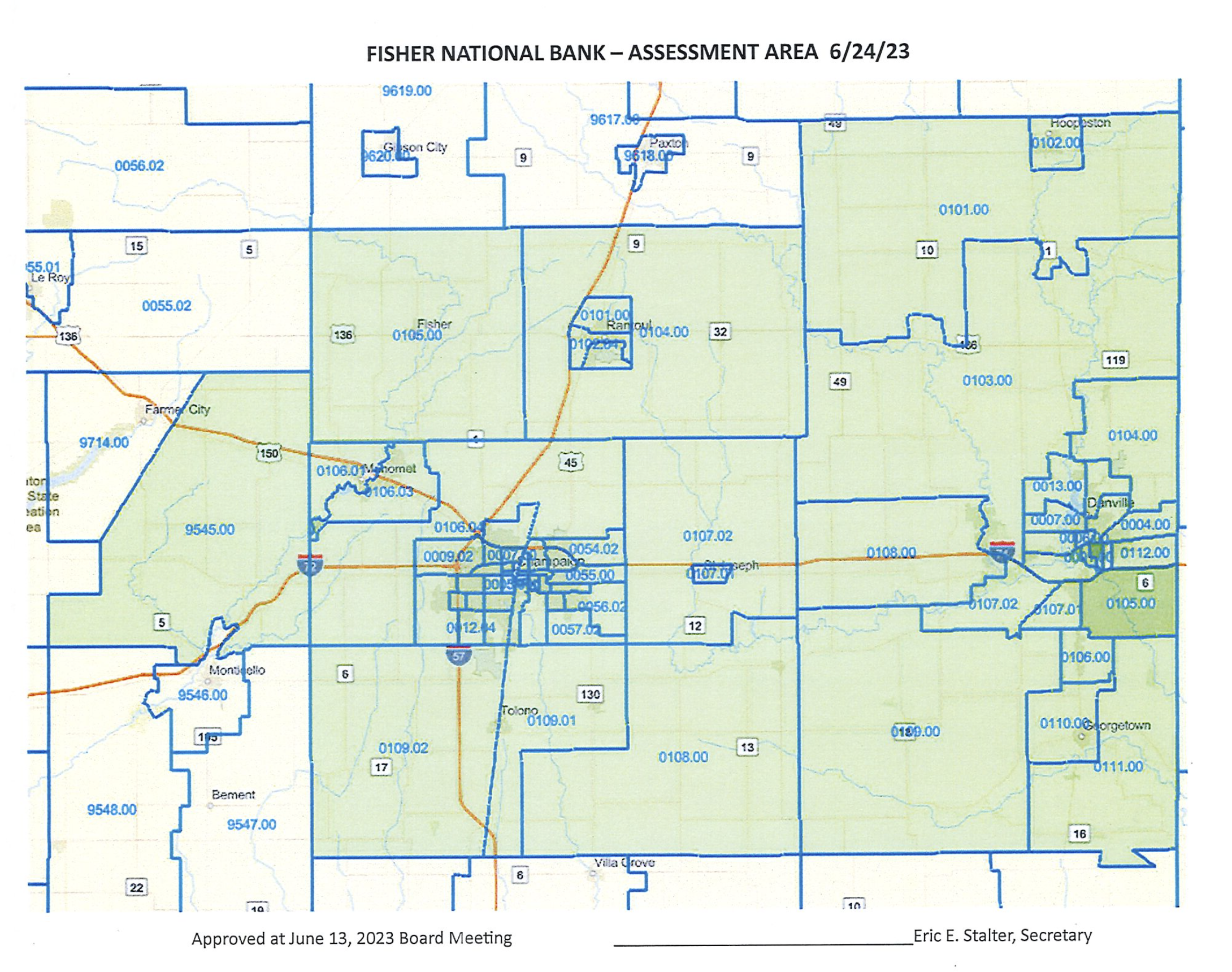

Assessment Area

Current Rates

Current Products

Click here for current Checking products

Click here for current Savings products

Click here for current Loan products

Schedule of Fees and Charges

Check printing fees vary by the style of check order.

| The following fees and charges may be assessed against your account: | |

|---|---|

| Check printing | Fees vary by the style of checkorder |

| Replace lost ATM card or Debit Card | $10.00 |

| ATM cash withdrawal at non-proprietary ATMs | $0.75 |

| Legal Fees | $50.00 |

| Cashier's Checks | $3.00 |

| Account balancing assistance (first time free) | $10.00/hour |

| License Sticker Fee (each) | $7.50 |

| Overdraft/Nonsufficient funds (NSF)* - each | $30.00 |

| Sweep account fee - per transaction | $10.00 |

| Account activity printout | $1.00 |

| Collection Items | $30.00 |

| Stop payment-each | $15.00 |

| Fax service (incoming/outgoing)-per page | $1.00 |

| Photocopies | $0.15 |

| Wire transfers (domestic)-incoming/outgoing | $20.00 |

| Wire transfers (international)-incoming/outgoing | $75.00 |

| Monthly Dormant account fee (after 36 months inactivity) | $3.00 |

Business Account Fees

| The following fees and charges may be assessed against your account: | |

|---|---|

| Online Cash Management | $5.00/month |

| Positive Pay | $30.00/month |

Corporate Checking Account

$100.00 to open account, no minimum balance, free debit card, free online banking with valid email address, free online bill pay, free online statement ($5.00 charge per month for paper statement), return check fee $5.00, $5.00 monthly maintenance fee (waived if average daily balance is $10.000.00 or more).

Small Business

$100.00 to open account, free debit card, free online banking with valid email address, free online bill pay, $5.00 monthly service fee if balance falls below $100.00 during the statement cycle, free electronic statement ($5.00 charge per month for paper statement), $5.00 return item fee.

*The categories of transactions for which an overdraft/NSF fee may be imposed are those by any of the following means: check, in-person withdrawal, automated clearing house or transfer. NSF fees will be charged each time an item presented for payment is returned due to insufficient funds in your account. The fee may be charged multiple times on the same item, and could be assessed as often as daily. There is no limit to the number of times the fee will be assessed on the same item when presented multiple times.

HMDA Disclosure Statement

Home Mortgage Disclosure Act Notice

HMDA data about our residential mortgage lending is available online for review. The data shows geographic distribution of loans and applications; ethnicity, race, sex, age, and income of applicants and borrowers; and information about loan approvals and denials. This data is available online at the Consumer Financial Protection Bureau’s website: www.consumerfinance.gov/hmda

HMDA data for many other financial institutions is also available at this website.

Public Comments

Greater Champaign County AMBUCS - September 20, 2024

Thank you for making our 21st annul golf outing a successful event. Through your assistance and generosity, we have exceeded our goal in raising funds, which has resulted in more local projects being funded. We were able to raise over $13,000.00, which will allow us to purchase severla new AmTrykes for local children who really need our help.

The Greater Champaign Country Chapter of AMBUCS is very proud and appreciative of your support and participation in our fundraising event. We trust you recieved some enjoyment along the way. Next year’s golf outing is already being planned. We certainly hope that you will choose to join us again in 2025.

From the membership of The Greater Champaing County Chapter of AMBUCS, we sincerely thank you. If you or anyone you know needs assistance in our area of work, please do not hesitate to call any club member.

Sincerely,

Don Dunlap, Golf Committee Director, Greater Champaign County Chapter of AMBUCS